Do I Need Homeowners Insurance For A Rental Property

Insurance is necessary to protect you from all of the risks you face as a landlord. There are different options available for homeowners when choosing the right insurance policy, and the decision to purchase requires careful thought. For example, homeowners insurance differs from Landlords Insurance.

We want to share how to choose the appropriate insurance for your property and the benefits. Our team truly desires that our clients enjoy a lifetime of successful property ownership, and property insurance is one detail you should not overlook.

Best Rental Property Insurance

The best rental property insurance is one that matches your property’s specific use to the risks you face as a landlord. Choose a reputable company that offers the coverage you require at the very best market rate. The cost of your rental property insurance will be related to things such as; the geographic area, the coverage amount you select, and the length of time you rent the property throughout the year.

Other things that will affect the cost of property insurance include the roof type, age of home, and distance to the coast. Landlord Insurance is the best rental property insurance if you leave your home rented out for six months out of the year or longer. There are many reasons that this is the case. Keep in mind that the best coverage for you is not always the cheapest. Because of the increased protection that landlord’s insurance offers, the cost may be on average ten to twenty percent more than a standard homeowners insurance policy.

Benefits of Landlord Insurance

Landlords Insurance is beneficial to property owners because they can choose from different options for keeping their rental property covered appropriately. Landlords may decide how much personal property coverage is right for them. A common misconception among people is how a landlord insurance policy covers personal items.

Personal items are covered differently from the standard homeowner’s insurance policy. Landlord insurance likely will not cover gadgets you leave at your rental property unless they serve the property. However, it may help cover items such as a snowblower or lawnmower that you store on the site to help maintain the property.

Landlord Insurance Coverages

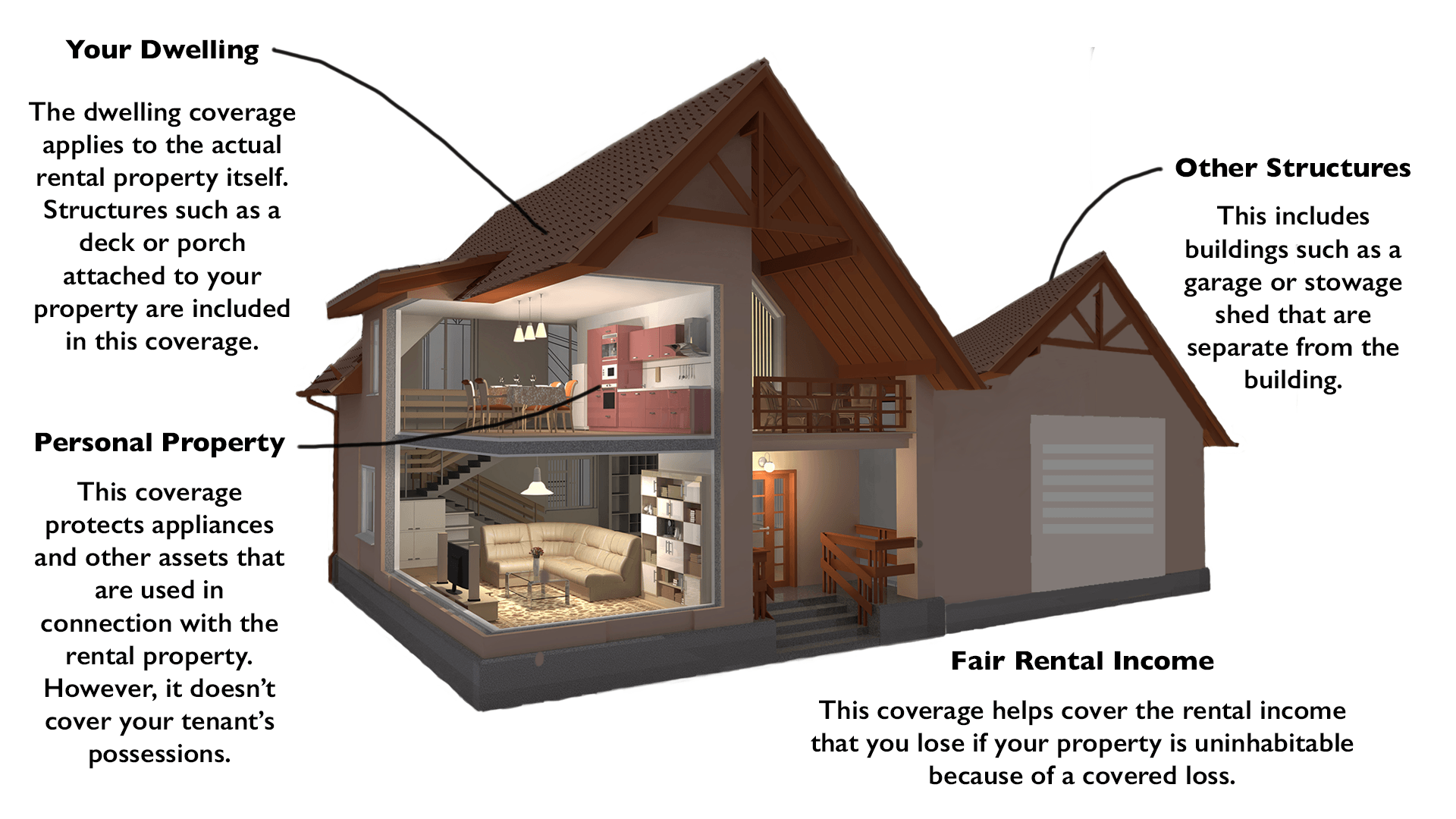

Landlord insurance has many of the same coverages as a standard homeowner’s insurance policy; Dwelling coverage is the amount used as the limit to repair or replace your property after a covered loss. Other structures include buildings such as a garage or shed separate from the dwelling.

Liability coverage for a full-time rental is different because it typically only provides liability coverage relating to the rented premises. That means any accident or injury you are held legally responsible for is covered if it happens to someone at the property you are renting out. As an example, let’s say a broken floor tile causes your tenant or one of your tenant’s guests to fall.

You may be found negligent for leaving the property in disrepair and forced to pay for the injured person’s medical bills and lost wages. Liability insurance will help protect you from the financial loss associated with this accident, including legal defense and a portion of your lost wages when attending trials and hearings.

Fair Rental Coverage

You can only purchase fair rental coverage with a landlord policy. It is a beneficial coverage that protects the income you generate by keeping your property rented out. When a covered accident causes the property to become uninhabitable, your insurance policy will pay you extra to compensate for your losses.

Look at your policy closely, and ask your insurance agent to tell you the exact limits. Limits are typically for a maximum of 12 months until you fix the property and up to a certain amount shown on your policy.

Renters Insurance for Rental properties

Many landlords require tenants to have coverage for their items such as furniture, clothing, and appliances before they move in. That is because your landlord’s insurance policy does not cover any of those things. Remember, landlords insurance only covers personal items you leave at the property to maintain it.

Renters who live at your property can purchase a renters insurance policy that offers $25,000 worth of coverage for only a few hundred dollars a year in most cases. Renters insurance also provides liability and medical payments coverages.

We hope that you now have a better understanding of how insurance can help you as a landlord and the benefits of owning a good policy. Please contact us with any questions. We look forward to serving you.